THE WEALTH DIVIDE

We all know that the rich are getting richer and the poor are getting poorer. The only question is: How long can this continue before there is a collapse in society as we know it and/or a revolution? Something has to happen. The key is not to have endless conversations about the problems that are just symptoms of something else. We have to dig deeper and reveal what the true causes of these problems are.

The old biblical saying “For the love of money is the root of all of evil” is turning out to be true! Governments are now at the beck and call of central banks and which means they no longer have control over their own financial policies and the taxes we pay them. Bankrupt countries and global banking institutions are being bailed out with national debt which citizens will have to pay back.

When asked, “What is the central role of politicians and government?”, my answer is always the same: “They have to manage the money we give them (in the form of taxes) for the benefit of ALL the people”. This is something most governments seem to have forgotten. Sometimes, when you hear governments talking about spending, you would think it was their money. The fact is, without taxes from the people, there would be no government!

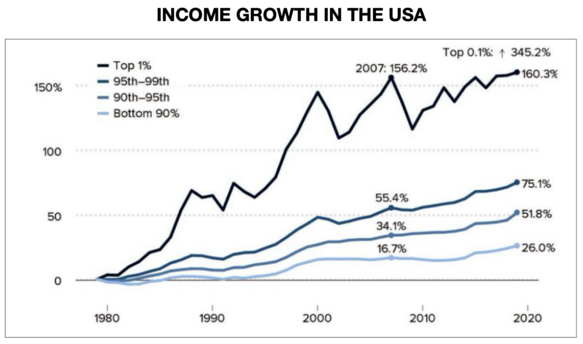

To get governments to enact laws and regulations for the benefit of all of us is probably the only place left in modern society where the less fortunate can fight back and try and stop the ever-growing gap between the rich and the poor. This gap is increasing because the Capitalists’ wealth is growing at a breakneck speed but the income of the Poor is gradually decreasing due to inflation. This has been going on for decades and is now accelerating.

The problem lies in the structure of our financial system and the laws and regulations governments have passed. If you have access to the capital you are able to invest. The gains you make are then taxed at a much lower level than income made from working. It varies from country to country but on your investments, you will normally never pay more than 25% on capital gains, and then only when realized. In some cases, it could be zero. On income from work, based on tax progression, you are likely to pay upwards of 40% of your income in taxes. In many European countries, the tax progression will take this above 50%.

The only way to change this is to elect a government that rewards work more than capital gains. This is a core problem. I once read an article in the USA that said if there were a voting requirement that everyone (100%) had to vote, the Democrats would always win by a wide margin. Instead, there has always been a movement to try and prevent poorer voters from voting by the Republicans. Who are the main supporters of the Republicans? - The Wealthy!

Trickle-Down Economics

The Wealthy have always been big proponents of “trickle-down economics” and promote its adoption by financing those political parties who promote it. The classic case is the USA, where several Republican administrations have sold this philosophy to the electorate, supported by the Wealthy. The only problem is, it has never worked for the Poor.

The theory behind trickle-down economics is simple. You cut taxes for the Wealthy and the benefits are supposed to trickle down to the Poor and middle-class. It is supposed to encourage the Wealthy to invest in their corporations and create more jobs for the middle and lower class citizens, meaning the benefits are enjoyed by everyone. It is claimed, the lost tax revenue will be regained by the economic activity created by these new jobs and the taxes on workers who now have higher incomes.

The problem is the Wealthy have always pocketed this money for themselves. They use this money not to create more employment, but to increase their own wealth. Jeff Bezos, the owner of Amazon, has more than enough money, courtesy of “tax planning”, to pay employees well. Instead, he increases his fortune even more through continued exploitation and underpayment of his workforce. Only Bezos benefits together with other wealthy executives at the very top of Amazon and their shareholders.

Real income for the Wealthy has seen a meteoric increase over the past 40 years whereas the Poor has seen a constant decline in their wages, adjusted for inflation. Although the chart shows an increase of 26% for the bottom 90% of the population from 1980 to 2020, inflation increased by 33% over the same period. This represents a decline of 7% in real purchasing power for the Poor. In other words, 90% of the population in the USA has experienced an actual decline in their income.

The Wealthy continue to maintain that trickle-down economics works but the actual results show a different story. They have never worked. My explanation is somewhat simpler and more basic.

What would happen if tomorrow all consumers in Western Society were to stop buying anything? No food, no gasoline, no electronics, no clothes, no cosmetics, no cars, no vacations, no rent and no taxes and so on?

Society as we know it would no longer survive. Stock markets would collapse, property values would decrease, companies would go bankrupt, and governments could do nothing about it! They could even reduce the taxes on the Wealthy to zero and it wouldn’t help. In my view, one should always test assumptions by applying the absolute worst scenario to see if the theories hold up.

This assumption shows that without the Poor buying and paying for the products and services of the Wealthy, their income and wealth would eventually be reduced to zero. Such a scenario is, of course, not realistic but it tests the assumption about where and how wealth is created. It also forms the basis of the proposal for the “trickle-up” scenario. The more income you give the Poor, for example in tax cuts and social assistance, the more they are likely to consume and the wealthier the Wealthy become.

Currently, such a scenario is playing out right in front of us. The Corona pandemic has put extraordinary stress on most Western Democracies, interrupting almost all the normal economic processes. Under normal circumstances, corporations would have to reduce their labor force as demand or their products and services subsides. Some would have to declare bankruptcy. This would lead to a massive reduction in tax income for governments and a massive increase in social benefits with long-lasting implications.

What has happened? Governments have decided on a “put-things-on-hold” strategy. They are financing the loss of income of workers by paying them to stay at home - on the condition that employers don’t cancel their employment contracts! They are really protecting the Wealthy from a massive drop in consumption and huge losses. Families are having to be more cautious but they are still able to continue more or less as before. They are being paid by the government, not their employers.

A crazy side effect of this philosophy is the wealth development on the world’s stock markets. Almost around the world, stock markets are hitting all-time highs day after day and inflation is at a 30-year high. How is this possible during the current Corona crisis and the economic downturn? It is only possible because the Wealthy are buying into this “put-things-on-hold” philosophy, expecting things to come back to normal in the not too distant future. They are assuming there could be an explosion of built-up demand after the epidemic is over. More on this subject in the Wall Street segment below.

Globalization

Globalization has been one of the biggest gifts ever to the Wealthy. Not only have they been able to transfer production of their products (and some services) to low-income countries, undercutting their own workforces and increasing their profits, they have been able to move capital around between countries and continents with the ability to hide profits and pay less or even zero taxes.

This has been described by some as modern slavery. Even large corporations with household names are involved in this movement, manufacturing products where they only have to pay wages of a few cents per hour and avoiding cumbersome, and expensive, environmental regulations. Complete domestic industries have been eliminated in this process which will never return.

A side effect of this change is, not only do traditional domestic industries disappear, but it also reduces the ability for local, organized labor movements to recruit new members to react. Domestic wages have therefore declined and there are no labor unions to create some sort of protest.

But the real benefit globalization has given to the Wealthy is the ability to avoid paying taxes. Rules for paying any type of tax are almost always regulated from country to country, not globally. This means that global corporations can choose where they do or don*t pay taxes.

The trend for corporations to become more global has accelerated in the past two decades as they merge to get an economy of scale. Now corporations like Google, Facebook, Amazon, Apple, Volkswagen, and more have become less transparent to local tax authorities, resulting in lower tax income. Income that is supposed to be used to the benefit of Democracy as a whole.

Tax Evasion

The Wealthy call this “tax planning”. They are able to employ teams of highly qualified financial experts to make sure they pay as few taxes as possible. Tax planners are regarded by many as highly reputable and well-paid professions, despite the fact they are just robbing governments and the people of the taxes they need to provide vital services for the poor, the sick and the underprivileged.

Some of the largest corporations in the world pay little to no taxes at all. Some countries have attracted these major corporations to establish their headquarters in their country by offering them an extremely low, corporate tax rate. Well-known countries on this list are The Netherlands, Ireland and some of the Caribbean Islands. But even some of the States in the USA have turned themselves into tax havens.

South Dakota, North Dakota, Delaware, Nevada, and New Hampshire have become popular places for the wealthy to park billions of dollars in secrecy. South Dakota, for example, has more than 100 trust companies that manage $367 billion in assets, which ballooned from $75 billion in 2011.

Base erosion and profit shifting (BEPS) is the name given to this questionable practice. Multinational enterprises exploit gaps in the international tax rules and shift profits to low-tax jurisdictions. These tax avoidance strategies are in most cases legal and largely overlooked. Capitalists are taking advantage of tax rules that are not well coordinated across countries and which have not been updated in a globalized economy.

BEPS is bad for everyone. Just the USA loses much-needed funds, conservatively estimated at around 4-10% of global corporate income tax revenues, or USD 100-240 billion annually, money that could be spent on education, health care, infrastructure, and pensions. Consumers lose out either by having to foot the bill themselves through higher taxes for these services or going without them. Moreover, smaller, domestic companies have a hard time competing with these multinationals that lower their tax bills by shifting profits offshore.

Working consumers pay taxes each and every month, while the Wealthy can defer paying taxes for decades, if not indefinitely. The tax code’s preferences for capital income over wage income fuel the concentration of dynastic wealth among the nation’s billionaires. The Wealthy avoid paying taxes by indefinitely holding on to their assets and then just borrowing against those assets to fund their lifestyles.

This means they opt out of paying taxes and instead pay only low-interest rates on loans from Wall Street banks which in some cases become tax-deductible. As a result, middle-class families who earn their income from wages and salaries face substantially higher average tax rates than billionaires. This doesn’t even sound right.

Political Influence

It is no secret that government enacts laws and regulations for Society. This is why the government is one of the prime targets for the Wealthy. They want to make sure the politicians who get elected are on their side. This they do by financing the election campaigns of their chosen candidates.

Money dominates U.S. political campaigns to a degree not seen in decades. Super PACs allow billionaires to pour unlimited amounts into campaigns. Dark money groups mask the identities of their donors, preventing voters from knowing who’s trying to influence them and races for a congressional seat regularly attract tens of millions in spending. It’s no wonder that the Wealthy have a plan to exert total control of the government.

After elections, the Wealthy employ armies of lobbyists, people who keep in constant contact with politicians and their party, to influence the decision-making process. In many cases, these lobbyists are former politicians who know the ropes, have full access to the parliament buildings, and know personally many of their ex-colleagues still in power.

Smoke and Mirrors

One of the most used philosophies by the Wealthy in the USA is the rule “You scratch my back and I’ll scratch yours”. What does this mean? When applied to politics, it means “If you (the politician) do what I want, I will make sure you get elected”, through massive support and campaign contributions.

There was an infamous ruling by the Supreme Court in the USA on January 21, 2010, called “Citizens United”. A conservative nonprofit group called Citizens United challenged campaign finance rules after the Federal Election Committee stopped it from promoting and airing a film criticizing presidential candidate Hillary Clinton too close to the presidential primaries.

A 5-4 majority of the Supreme Court sided with Citizens United, ruling that corporations and other outside groups can spend unlimited amounts of money on elections. This opened the door for millions to be spent by so-called “Interest Groups” and has allowed the Wealthy to control the election debate in their favor. The ruling, based on an argument about free speech, has basically put corporations on the same footing, with the same privileges and protection, as normal citizens. It opened the door for massive corruption and has also led to foreign influence of the American political process.

This is probably the most blatant global example of money controlling a Democracy and taking away from the average citizen the ability to enact changes and improvements to his/her situation. The problem is this is happening in the World’s largest economy (USA) which has for centuries been the shining example of how Democracy should function.

The result of such tactics that the Wealthy use in the USA is they protect their own wealth, and get it to grow substantially. At the same time the wealth of the Poor has declined and their income has not increased over decades when adjusted for inflation. The question now being asked is how long can this continue? One thing I have learned from statistics is they show a trend that always continues unless something changes to alter it. What will this be?

If we dig deeper into the numbers we find the problems are much worse than they appear initially. Many of the trends are pointing in the wrong direction. Let’s take the question of retirement as an example.

Retirement

There are many examples of politicians and experts discussing symptoms instead of the actual causes of problems which need to be resolved. One of these is the very important subject of retirement. How do we as a Society prepare for this very important part of our lives?

Many of the so-called Millennials were either studying or leaving college when the financial crisis of 2008 hit. Many of them never found a job equivalent to their education status and started financially on the wrong foot. Now we have the Corona epidemic which doesn’t appear to be going away soon, and will prevent any major recovery for the Millennials who will soon be approaching 40. How will they be able to finance retirement?

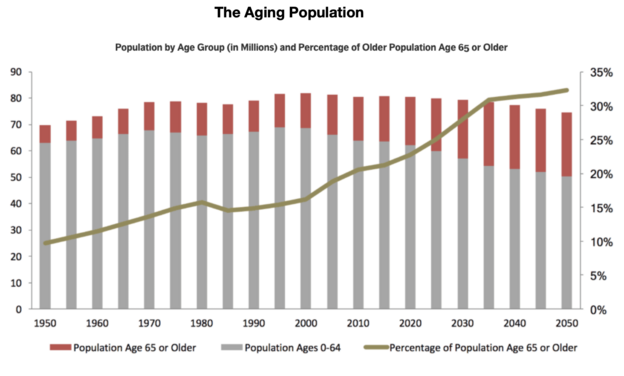

Then we have a declining population together with an aging population. In most developed countries the birthrate is now below the required number per family to sustain the current population. Falling fertility rates mean nearly every country will have shrinking populations by the end of this century. 23 nations are expected to see their populations halve by 2100.

For example, Germany’s fertility rate of 1.54 children per woman is still below the U.S. figure of 1.64 and short of the so-called replacement rate of around 2.1, seen as necessary to sustain rich-country population levels. Some estimates are forecasting a drop of 20 million people in Germany by 2050 and being cut in half by 2100. What will that do to consumption and the economy with 40 million fewer people?

Populations are also aging dramatically, soon with as many people turning 80 as those being born. Right now there is no solution in sight for retirement plans as the retired population will grow to be larger than the working population.

The discussion around this problem has focussed on the financing of pensions, the symptom, and not about getting families to have more children, the cause. It is very simply a family planning problem and there are no plans in sight to increase the birthrate by making it more attractive to raise a family.

The real question is why the birthrate has dropped so dramatically in the first place? I will take Germany here as an example, but this is a global problem occurring in most modern Democracies.

It is both a financial and a moral issue that politicians want to avoid.

On the one hand, creating a family can be an expensive proposition and most couples cannot afford children as they are already forced to both find jobs to be able to finance their current existence. Governments would also prefer to increase the working population as it provides a larger base for taxation which is their source of funds.

On the other hand, Society has developed the concept of equality, in particular between genders. This has created a need for the female population to compete with their male counterparts in the workforce. In many professions, governments have even passed laws and/or created goals mandating 30% of the workforce should be women.

The end result of both of these issues: fewer babies!

Governments have introduced a wide range of “so-called” solutions to alter these trends that are not working. Daycare facilities and kindergarten are supposed to offer a place to take care of the kids while both parents work. This can get complicated and expensive and the question then arises, who should cover the costs?

The real solution to this problem is to make it more attractive and financially beneficial to raise a family. This doesn’t mean that every woman in the nation should be staying home to produce kids but the possibility of creating a family should be made more attractive for many.

As in most cases in our Western Society, it always comes down to money! Imagine having a Child Income Benefit (CIB) of $600 per month, increasing by $100 for every additional child conceived. In other words, a family with three children (which we need to maintain the current population) would receive a total benefit amount of $2.100 ($600 + $700 + $800), tax-free every month. A family with four children would receive monthly $3.000 - tax-free. Would this change any attitudes towards raising a family?

This also doesn’t mean that women couldn’t have a career. With the Child Income Benefit, families could afford to employ extra help with the family chores so the wife or husband could continue to study or work part-time. In this concept, the time spent at home taking care of the family would be fully credited financially towards the parent’s retirement account, something women for a long time have been fighting for.

Although this is not part of this discussion, these types of thoughts lead us to the debate around the concept of Universal Basic Income (UBI). However, CIB is not the same as UBI. The CIB would encourage families to have more children, something UBI is not designed to achieve. However, as a potential change to how Society could function, both CIB and UBI will continue to be tested as real alternatives. One of the common questions is, how can such programs be funded??

The standard answer is, the Wealthy would have to foot all or a large part of the bill. They could certainly afford it! However, with such a Child Benefit Income the dynamics of business would change. It has long been well established that if the bottom half of wage-earners get access to excess cash, they spend it, not save it. This would lead to the opposite of the “trickle-down” effect and would create a “trickle-up” effect. Private consumption would increase.

The billions such a program might then cost, would end up back in the economy as consumption, creating a much greater demand for products and services that would then finally benefit the Wealthy. The “trickle-up” effect.

The huge increase in consumption taxes (VAT) plus the surge in employment with increasing income tax revenue, would pay for the vast majority of the program. CIB could also replace some of the social benefits already in place to help with its financing.

Now we are at least trying to solve the real cause(s) of the problem and not getting lost in endless solutions about the symptoms. If we do nothing, the problem doesn’t go away and just grows until it is too late.

None of these problems apply to the Wealthy, of course. They create their own retirement accounts using the tools available only to them. They have learned that working for income is a losing game and that getting capital to work instead is more profitable and easier to control. Taxes can be postponed and the money can be moved around globally at the click of a mouse.

Leading the Wealthy are entrepreneurs like Elon Musk from Tesla, Jeff Bezos from Amazon, and Mark Zuckerberg from Facebook (now Meta). It is true they may have created something of value which is also unique but they are achieving their goals on the backs of the Poor. Their extreme wealth is created through the ownership of their own companies’ shares, which are bought by other Wealthy participants.

Wall Street

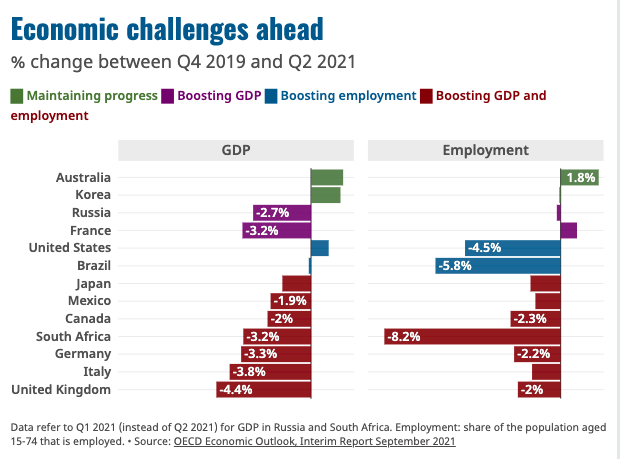

Currently, we have a new phenomenon not seen before when it comes to wealth created at stock exchanges. The current global economy is in a crisis mainly caused by the Corona epidemic and the subsequent slow recovery. The Poor are having a problem getting back into the workforce to make ends meet with inflation hitting new records and is now around 6%, 4% higher than the stated target of all the central banks (Fed and ECB). Some might call this “chaos”.

But the stock markets are hitting new highs every week and the Wealthy are getting wealthier by the minute. How can this be? When crises occur, like the Corona pandemic, governments decide to protect corporations from potential bankruptcy by flooding the market with extra money which the Wealthy have access to and which they plow back into the stock market by investing.

To make this palatable, the central banks have reduced interest rates on money to below zero. So the money the Wealthy are borrowing to buy shares to make money doesn’t even cost them much.

Recently a new company by the name of Rivian Automotive entered the Stock Exchange on Wall Street with an IPO. It plans to build electrically driven trucks and is riding on the hype created mainly by the Tesla corporation. Rivian's stock price soared the day after its Wall Street debut, valuing the company at more than $100 billion!

Rivian plans to deliver only one thousand vehicles by the end of 2021 but is already worth more than every other automaker with the exception of Tesla, Toyota, and Volkswagen, including Ford and General Motors, which will both likely sell more vehicles in a day than Rivian will in the entire year.

The current price is $129 per share, up from its launch price of $78. This is a gain of more than 65% in just a couple of days. If I had bought 1,000 shares at the launch price with the money I could have borrowed, I would have made $51,000 in just a couple of days. This is more than the annual income of more than 50% of US workers. No wonder this promotes a huge gap between the Wealthy and the Poor.

The Stress Test

Whenever one wants to test the strength of anything, whether it be a physical structure, a law, a social structure, or even a personal relationship, one should create the “worst-case scenario” to see whether the structure holds and survives. It is standard practice in many professions.

It is something politicians never want to do, at least not voluntarily. Sometimes unexpected things happen when the stress test arrives such as war or an economic depression. Currently, such an event has arrived worldwide - the Corona epidemic. This is a different type of test as it involves almost all facets of government functions, including decisions about finance, logistical challenges, moral questions about vaccinations, global cooperation, and even shutting down large sections of the economy.

Most governments until now have decided to throw money at the problem and wait until the epidemic subsides. One of the questions which arises is, whose money? National lockdowns have to occur where employees are forced not to go to work and, to avoid mass terminations, governments have stepped in and provided guarantees to both employees and employers, costing governments billions in debt.

One of the assumptions is Society will get back to normal eventually when the epidemic passes. Back to normal? This is one of the key assumptions which has been adopted because governments can understand what “normal” is and the quicker we get back there the better. However, there are no guarantees this will happen, in fact on the contrary. Most countries in the Western Universe are facing the so-called “fourth wave” arriving this winter, with a population who is tired of restrictions and wants “the normal” back. Could this be the spark lighting the fire of discontent?

Many experts are now saying the Corona epidemic will be with us for some time to come. This is going to put governments, corporations and consumers under pressure we haven’t seen before. The big question is if the current Democracy vs. Capitalist structure is going to survive under this stress? If the pandemic continues the financial stress countries will have to endure might be overwhelming.

If the pandemic destroys the foundation of what is now “normal”, the question then arises, what could it be replaced with? It is going to take time to find out as the epidemic spreads across the globe slowly, often impacting companies and their global supply routes, something it seems stock markets have decided to ignore. If Corona doesn’t pass or maybe even gets worse with new strains of the virus arriving from other parts of the world, could this lead to a major global financial depression?

Imagine stock markets crashing at a time when national debt levels are unsustainable, banks fold under the pressure of junk debt, inflation hits double digits and unemployment creates not only a financial problem but a sociological disaster. Possible? Impossible? The fact is nobody knows as our Democracy has never faced such a problem before and Capitalism could collapse anyway under the lack of capital circulating in the system.

This might be an exaggerated scenario but it is staring us in the face right now.

The End Game

So the real question that has to be addressed is: What will happen to the wealth divide we already have between rich and poor if a global recession should develop because of the Corona pandemic? Right now, this is still a real possibility.

We have a number of examples from the past from which to draw some conclusions, the most recent being the financial collapse of 2007/2008. This global recession occurred because the financial institutions were profiting from globalization. They started lending money on conditions around the world that were so lapse, it was only a question of time before the pack of cards would collapse. What then happened?

Governments around the world took taxpayers' money and bailed out the banks! The argument was that if the banking system collapsed this would create a doomsday scenario for many countries that were sinking under their own debt. During this “interim period” the Wealthy were able to transfer their millions out of their endangered accounts while the poor weren’t able to get any cash out of the ATMs.

In many cases, the top management of some of the biggest banks around the globe was able to keep their jobs while many working for an income became unemployed, with all the personal and family problems this creates.

Such events only increase the divide between the rich and the poor and raises the question again, how long can this continue? All around the world, also in our developed economies, this development has reached questionable levels. Change is still not in sight, other than some rumbling in the political sphere. It seems the time has come when the people take back control of their own destiny and maybe it will take a change in generations for this to happen.

We have recently seen a rise in the interest in climate change, which is a major global problem. This is happening at the same time when a new generation is coming of age with the ability to vote. Maybe this is the moment the “revolution” could take place. In most countries, the politics of the Green Movement is situated more to the left of center which will probably not be adopting the policies of right-wing parties which are now supported by the Wealthy.

The change can only take place by electing politicians and Parties who will create the necessary regulations to make it happen!

Colin Buckingham

22. November 2021