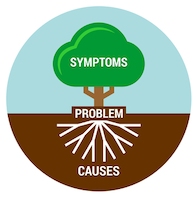

As we watch society disintegrating all around us, it is clear we have problems to address. This raises the most important question of all: What is the difference between a problem and the cause of a problem? Are we supposed to be discussing the symptoms or the causes of the problem?

In the vast majority of cases, the problems we are trying to resolve are just symptoms of another underlying issue. The discussion about symptoms then becomes endless as we never get to the core of the matter and don’t spend our time, energy, and resources on ways to resolve the core of the problem…The Cause.

In the vast majority of cases, the problems we are trying to resolve are just symptoms of another underlying issue. The discussion about symptoms then becomes endless as we never get to the core of the matter and don’t spend our time, energy, and resources on ways to resolve the core of the problem…The Cause.

The classic example is the case of aspirin. You have a headache that just persists so you take a couple of aspirins. Problem solved! But are you resolving the symptom or the cause? Every time the headache returns you take another aspirin. This continues for months or even years until you are diagnosed with a brain tumor which was the cause of the problem.

This question should be raised every time an endless discussion develops from trying to solve a problem without the emergence of a resolution or a solution. Is it really the cause or just a symptom?

Let’s take a more complicated question which is going to be a problem for all of us and apply this principle. Retirement.

For the younger generation, it is not yet on their horizon but it should be. It is one of those issues that just creeps up on us, slowly but surely, and which is being discussed endlessly by numerous experts at all levels. My favorite example is the TV talk shows where this can be discussed forever, week after week, but a solution never seems to emerge.

What is the issue? In most democratic countries, the payment of retirement funds to the retirees is being funded from taxes on the working population. The problem occurs as the aging (retiree) population grows and the working population shrinks. As this is a major social concern, it is getting a lot of attention from the politicians, who want to please retirees who are an important, growing part of their voter base.

The symptom here is the lack of funds for retirees. The cause of this symptom is the falling fertility rates in western society, not ways that the funds can be managed or what percentages of income should be paid out! It is a family planning problem, not a financial problem.

THE AGING POPULATION IN GERMANY

Germany’s population aged 65 and older is projected to grow by 41 percent to 24 million people by 2050, accounting for nearly one-third of the total population. At the same time, the population group aged 15 through 64 will shrink by 23 percent — from about 53 million in 2015 to about 41 million by 2050. The retiree population is growing and the taxpaying population is declining. Not only that, retirees are now living much longer requiring an ever-extending payout period.

One of the solutions being discussed is to postpone the retirement age from 65 to 67 or even 70, thus keeping the retirees in the workforce longer. To further help with the financing of the problem the actual pension payout amount could also be reduced somewhat. The claim is this would solve the problem but in reality, it is just pushing the problem down the road. This is a family planning issue, not a financial problem, but this is never part of the discussion.

The real question to be asked is why the birthrate has dropped so dramatically in the first place? I will take Germany here as an example, but this is a global problem occurring in almost all modern democracies. It is both a financial and a moral issue that politicians want to avoid.

On the one hand, creating a family can be an expensive proposition and most couples cannot afford children and don’t have the time, as they are already both forced to find jobs in order to finance their current existence. This also fits the agenda of most governments who like an increase in the workforce as it provides a larger base for taxation which is their source of funds.

On the other hand, society has developed the concept of equality, in particular between genders. This has created a need for women to compete with their male counterparts in the workforce. In many professions, governments have even passed laws and/or created goals mandating 30% of the workforce should be women. This percentage will only increase in the future.

The end result of this development is fewer babies are born. Couples cannot find the time or money to grow a family.

Governments have introduced a wide range of “so-called” solutions to change these trends which aren’t working. Daycare facilities and kindergarten are supposed to offer a place to take care of the kids while both parents work. This can get complicated and expensive and the question then arises, who covers the costs? Just this one subject is already the core of endless discussions in the media and on the net.

The solution to this problem would be to make it more attractive and financially beneficial to raise a family. This doesn’t mean that every woman in the nation should be staying home to produce kids but that the possibility of creating a choice for the family should be made available.

As in most cases in our western society, it always comes down to money! Imagine having a Child Income Benefit (CIB) of $600 per month for the first child, increasing by $100 for every additional child conceived. In other words, a family with three children (which we need to maintain the current population) would receive a total benefit amount of $2100 ($600 + $700 + $800), tax-free every month. A family with four children would receive a monthly CIB of $3000. The CIB payments would continue until the child leaves the household. Would this change any attitudes towards raising a family and solve the many problems families are already experiencing?

Although it is not part of this discussion, these types of thoughts have created a debate around the concept of Universal Basic Income (UBI). However, CIB is not the same as UBI. The CIB would encourage families to have more children, something UBI is not designed to do.

One of the key questions is always, how could such a program be funded?

The standard answer is, the wealthy would have to foot a large part of the bill. They could certainly afford it! However, with such a Child Benefit Income in place, the dynamics of business would change. It has long been well established that if the bottom half of wage-earners get access to any excess cash, they always spend it, not save it. This would lead to the opposite of the “trickle-down” effect and would create a “trickle-up” effect. Private consumption in the economy would increase.

The major part of the billions such a program might cost would end up back in the economy creating a much greater demand for products and services that would then finally benefit the government and the wealthy. The huge increase in consumption taxes (VAT) plus the surge in employment with increasing income tax revenue, would pay for a substantial part of the program. CIB could also replace some of the existing social benefits.

Now at least we are trying to solve the cause of the problem and not getting lost in endless solutions about the symptoms.

This was just one example of complicating an issue and not finding a solution by not getting down to the cause of a problem. The only way to resolve any issue is to make sure we are focused on the cause, not just the symptoms. Otherwise, we will never get to a solution.

This is something we should always think about carefully no matter how big or small the problem might be, in our business, political and private lives. More articles will follow illustrating other examples of problems that could be resolved by just changing the focus on the root cause of a problem, so register to this blog.